High-quality Compounder Earnings Model

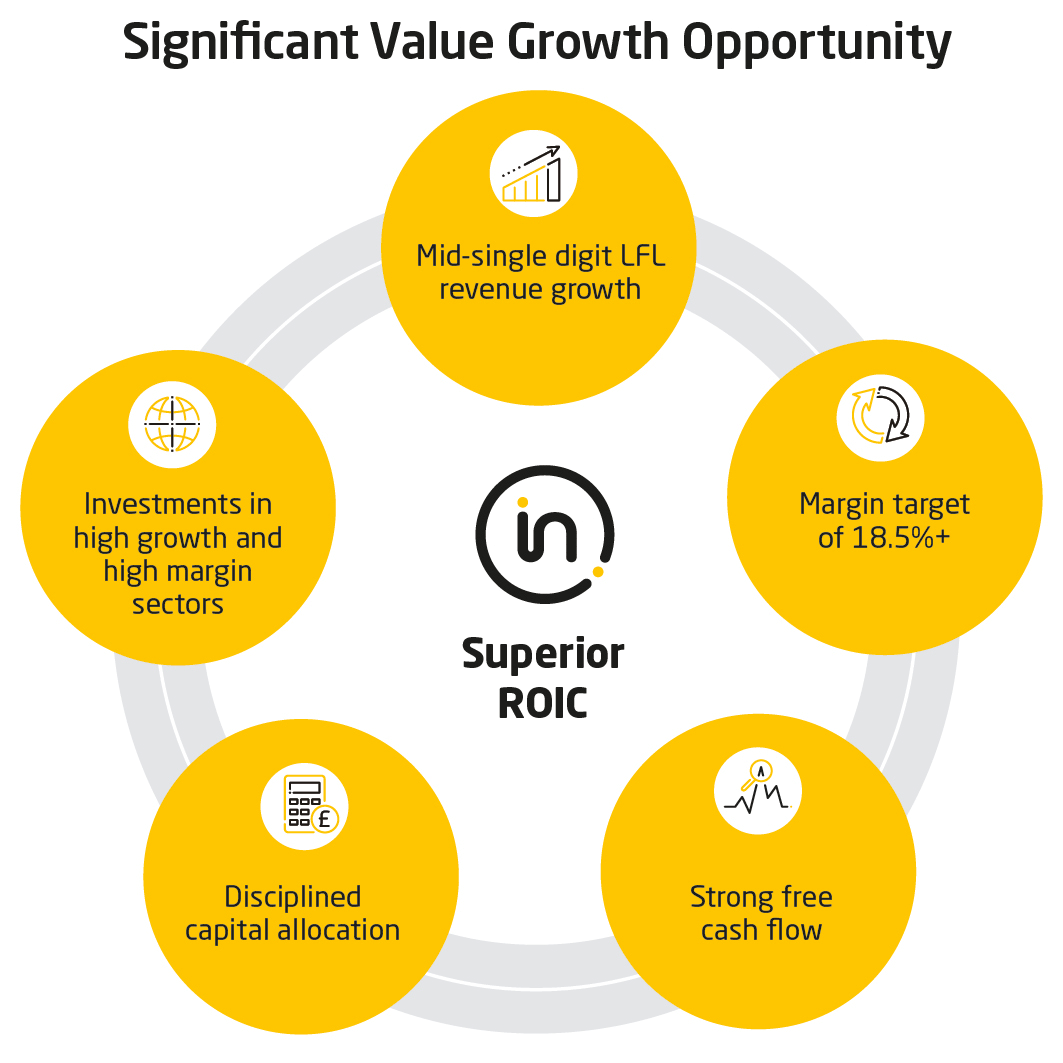

The value growth opportunity ahead is significant and our high-performance organisation, strong market position, industry-leading portfolio and unrivalled customer relationships mean we are ideally positioned to seize the growth in our end-markets. Our proven high growth cash compounder earnings model will continue to deliver significant value for every stakeholder every day, targeting mid-single digit LFL revenue growth, margin accretion, and strong cash generation, while pursuing disciplined cash-accretive investments in attractive high growth and high margin sectors to deliver superior ROIC.

| Financial performance metrics1 | 20142 | 2024 | 14-24 Chg |

|---|---|---|---|

| Revenue | £2,093m | £3,393m | 62.1% |

| Operating Profit | £324.4m | £590.1m | 81.9% |

| Operating Margin | 15.5% | 17.4% | 190bps |

| Diluted earnings per share | 132.1p | 240.6p | 82.1% |

| Dividend | 49.1p | 156.5p | 218.7% |

| Adjusted Cash Generated from Operations | 403.7 | 789.2 | 95.5% |

| ROIC | 16.3% | 22.4% | 610bps |

Notes (1): On an adjusted basis, (2) 2014 metrics are on an IAS17 basis